We make it quick & easy to obtain a Crypto license

Cryptocurrency exchange and the creation of electronic exchanges for cryptocurrency trading is a trend in the modern market. Our firm will help you create the most secure platform.

Looking for help? Get in touch with us

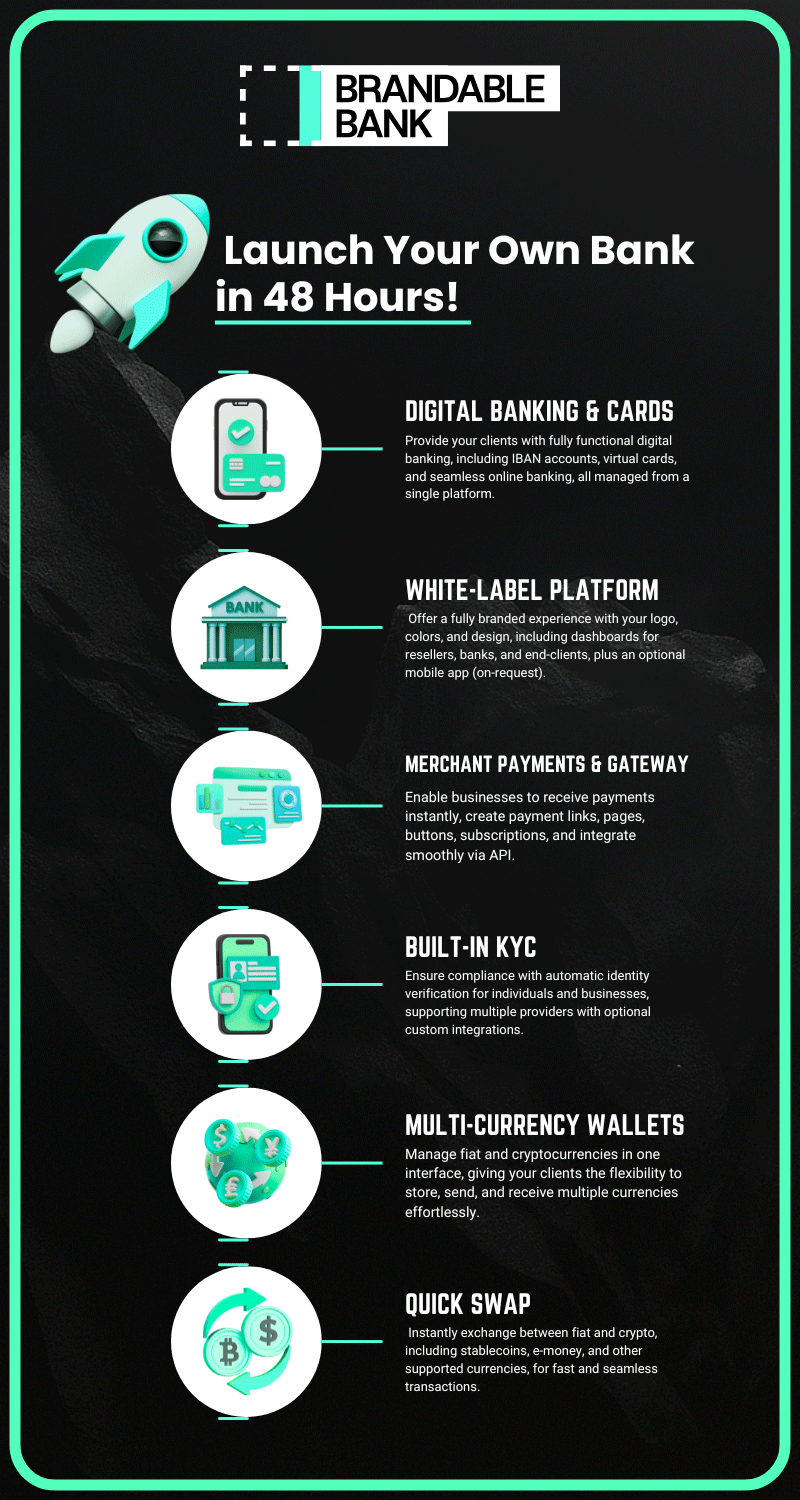

Our Crypto Services

Our company provides services to projects working in the field of blockchain technologies and cryptocurrencies. We provide support in such matters as organization of the structure, legal support, professional technical advising and marketing. If you need a license to exchange cryptocurrencies or build a business structure for mining cryptocurrencies, then our specialists will develop the best solution for you.

We can advise and provide the client with a solution both on a specific issue, and we can comprehensively approach the development of a large project in accordance with the client’s vision and market trends

Registering a crypto company in the Czech Republic provides many opportunities for running a successful international business. This license gives the company the right to conduct business throughout the European Union, which makes its services available almost all over the world. The advantages of the Czech Republic are the relatively low cost of labor, the transparency of the tax system.

Crypto authorized company have the right to conduct business throughout the European Union, which makes its services available almost all over the world. Low unit labor costs, easy access to the EU market combined with a large internal market as well as the fact that Polish employees are talented and highly skilled are all advantages for investors who start a business, in addition to the stability and incentives that are available.

Saint Lucia is known for its business-friendly environment and low corporate tax rates. The country has a stable political environment and a strong financial sector, which make it an attractive location for businesses looking to establish themselves. In addition, financial services regulatory authority of Saint Lucia has developed a clear regulatory framework for crypto assets and exchanges in order to ensure that local companies comply with the relevant laws and regulations.

Lithuania is 3rd most attractive taxation in the EU from OECD countries. Currently corporate tax rate on profit and income equals to 15%, 5% tax rate if annual profit less than 300,000 EUR and in company structure less than 10 employees. In addition, if your annual profit less than 300,000 EUR and in company structure less than 10 employees then you can benefit from 0% corporate tax rate for the 1st year.

Registering a crypto company in the Kazakhstan provides many opportunities for running a successful international business. This license is not limited by only Kazakhstan customers and gives the company the right to conduct business internationally, which makes its services available almost all over the world. The advantages of the Kazakhstan are the relatively low cost of labor, various tax benefits, favorable environment for investment and well-developed banking system.

With our service, we can get the process started ASAP.

Get in touch with us!